Table of Contents

More and more people are setting themselves up as online influencers. It might seem like a fun hobby at first—but if you’re earning money from your activities, you may need to pay taxes, just like you would for any other business. So, do influencers need to register as a business? Do TikTok influencers pay taxes? What about payments in kind? We’ll answer everything you need to know about influencer taxes.

What does an influencer do?

Influencers are people who build up a following through their online content, and “influence” their followers to take certain actions—such as buying products from a particular brand. This content may include blogs, vlogs, podcasts, and sponsored social media posts.

Influencers who are successful at engaging their target audiences are able to monetize their activities, either through brand collaborations or ads on their articles and channels. They don’t necessarily need millions of followers—major brands like Amazon and Coca-Cola have worked with nano-influencers (those with 1,000 to 5,000 followers) who seem relatable and authentic. Using tools like Nettilasku can help influencers easily manage invoicing for their services and keep their finances organized.

Via Kite.ly

Is influencer income taxable?

There are no specific “influencer taxes”, but you do have to pay taxes on your income from influencer activities if that income exceeds a certain threshold. That’s because you’re effectively running your own business.

The IRS categorizes influencers as independent contractors, which means you must pay self-employment tax (SE tax) as well as income tax. As you’re not a permanent employee of a company, you’ll pay both the employer and employee portions of your Social Security and Medicare taxes.

In the UK, self-employed earners must register for self-assessment with HMRC. All residents have a tax-free personal allowance of £12,570, and pay taxes on income above that amount. If you’re self-employed, you also pay your own National Insurance contributions.

If you’re a part-time influencer, you might have another job where you’re employed by a company. But you’ll still have to register as self-employed and pay taxes on your influencer income.

How do influencers report taxable income?

In the U.S., if you’re working on behalf of a company, and they’ve paid you more than $600 in a year, they should give you a Form 1099-NEC by January of the following year. You need one form from each company you work with. Earnings under $600 must still be reported on your tax return.

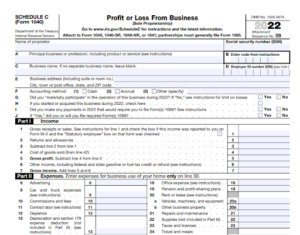

You’ll report your income on the Schedule C (Profit or Loss From Business) tax form. Subtract your allowable expenses from your gross income to calculate your net profit or loss, which is the amount you’ll be taxed on.

Most businesses make quarterly tax payments to the IRS, typically on April 15, June 15, September 15, and January 15. Remember, if you work for companies outside of your home state, you may have to file multiple state tax returns.

In the UK, you need to register for self-assessment with HMRC and fill out a tax return that covers all your influencer income. Again, you’ll only be taxed on net profit, making payments on January 31 and July 31. HMRC’s Making Tax Digital (MTD) initiative will help you to keep track of what you owe.

Via Freepik

Looking to run an epic influencer marketing campaign on social media? NeoReach has the best experience in creating viral campaigns that convert on social media. Sign up here!

What expenses can influencers claim?

The good news is that many expenses are tax-deductible, so you can subtract them from your gross income and lower the amount of influencer taxes you’ll have to pay. As long as these expenses are necessary for your job, you can deduct them.

For example, health and fitness influencers can deduct the cost of the clothing and equipment they use in their videos. If you’re in fashion and beauty, you can count beauty products and hair tools as expenses. Don’t forget about prizes and giveaways that incentivize your followers. You might offer a free gift for the first 10 people who share a certain post, or award a prize for the best selfie taken at the bar you’re promoting.

Other expenses may include:

- Computers/tablets/smartphones

- Cameras and filming equipment

- Website hosting

- Software subscriptions

- Marketing costs

- Travel costs

- Business insurance

If your computer or cell phone is for personal use as well as influencer activities, you’ll only be able to claim for the proportion spent on business use. It’s the same deal if you work from home—you can deduct only a portion of your household expenses.

Tips for managing influencer taxes

Paying taxes is never fun. But you need to give your tax affairs careful attention to avoid a penalty. Here are some key aspects to consider.

Identify your business

First, is it a business at all? If you’re just starting out as an influencer, and you’re not yet turning a profit, the IRS may categorize it as a hobby—which means your expenses aren’t deductible. Your activities will typically be viewed as a business if you’ve made a profit in three of the last five tax years. The IRS may also consider the amount of time you put in and your likely future profitability.

The default classification for influencers is “independent contractor”, but you could also register a sole proprietorship. You can then file influencer taxes through your personal income tax return, usually the IRS Form 1040 with a Schedule C supplement. Click here for a downloadable version of the form.

Another option is to form a Limited Liability Corporation (LLC). Do you really need an LLC to be an influencer? It’s not strictly necessary but is worth considering.

Because an LLC keeps your business and personal assets separate, your personal finances will be safe even if your business gets sued. To ensure you’re fully covered, it’s critical to create an LLC operating agreement that outlines the management and financial arrangements of your business, providing an extra layer of protection against potential legal issues.

For a new influencer, it’s all too easy to make mistakes when it comes to things like copyright and trademarking, so it’s a good idea to have this protection.

An LLC can also reduce the taxes you pay because it’s taxed as a pass-through entity, so the owner (and each other member, if applicable) only needs to file a personal tax return. This is good news for up-and-coming influencers who aren’t earning the big bucks just yet.

Get organized

Since you’re running your own business, however small, you’re responsible for reporting the income you receive from all your influencer activities. Even if you’re only a part-time influencer, it’s vital that you get organized and keep track of both income and expenses so that you can file your influencer taxes accurately.

It’s good practice to track your income and expenses throughout the year instead of leaving it until tax time—that way, you’ll also be prepared if you get audited! Set up a system for storing and tracking invoices, receipts, paystubs and the value of any other items you’ve received.

Use accounting software

The best way to keep track of your tax affairs is to use software to help you. Maybe you started out by using Excel or Google Sheets to record your incomings and outgoings, but that’s not going to cut it when you’re influencing full-time and partnering with multiple brands.

Good accounting software, such as Sage, will help you calculate the tax you owe. If you’re in the UK, you can learn more about accounting for self-assessment here.

Declare all gifts

The brands you promote might offer gifts, or “payments in kind”, in exchange for your services instead of money. For example, they might give you branded merchandise to wear in your videos, send you a product to review, or even give you a free vacation.

Anything you receive as compensation for your services is considered part of your earned income, so you’ll have to pay tax on the market value of the gift. However, if you’re sent products to review and their total value is under $100, you don’t have to include this on your tax return.

Via Freepik

Set money aside

The last thing you want is to find yourself short of money when it’s time to pay your tax bill. To prevent this situation, you could set aside money for your influencer taxes by putting a proportion of your monthly income into a savings account. It also makes sense to set up a bank account just for your influencer activities, keeping business and personal transactions separate.

Whether you’re creating blogs, TikTok videos, or social media posts, you’ll probably need to pay taxes on the income you receive—including cash and payments in kind. As we’ve seen, the process can vary depending on the type of business, so make sure you’re familiar with the relevant laws in your country or state.

By getting a grip on your influencer taxes, you’ll have more time to spend creating content!