Table of Contents

Let’s begin this post by saying Snoop Dogg released his very own NFT collection. So, if you’re wondering if NFTs, or non-fungible tokens, are still capturing the investing world’s fancy in 2022…the answer is a resounding fo-shizzle. So how will Snoop Dogg and all the other creators handle NFT taxation?

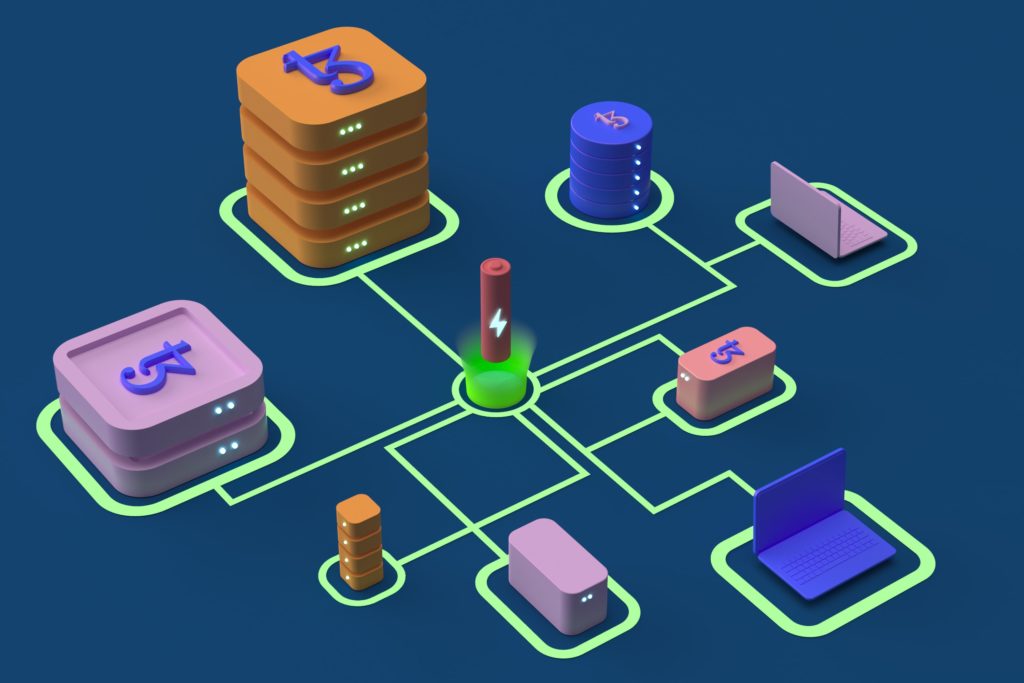

According to the Financial Times, NFTs became a $40 billion market in 2021. Sales of digital art such as NBA’s Top Shot and CryptoKitties have made their mark within the world of cryptocurrency. Forging their way as the new frontier of digital investments.

As AI-powered content creation revolutionizes digital marketing, NFTs have become status symbols. Celebrities, global brands, and investors want to be a part of the crypto landscape.

The impact of NFTs on our digital market has been astonishing. Despite this, the Internal Revenue Service (IRS) has yet to publish any clear guidance on NFT taxation for sales, creating uncertainty in the fast-emerging market.

Due to its mainstream popularity, traders are making a profit along with NFT creators. So whether you’re a creator, investor, or a legitimate business, you may have a few questions about NFT taxation that need answering.

If you’re part of top crypto communities or involved in NFT creation, this article will provide you with everything you need to know.

What is an NFT?

As an NDA template protects the sharing of information, NFTs protect its value via their singularity.

Because NFTs, like cryptocurrencies, are products of blockchain technologies, they can be tokenized. Meaning their value is in what the NFT represents rather than in the value of the token.

Unlike fungible cryptocurrencies such as bitcoin and cronos, NFT tokens aren’t interchangeable. Bitcoin and cronos assets can be swapped for another without changing their value, in the same way, a dollar can be exchanged for another dollar.

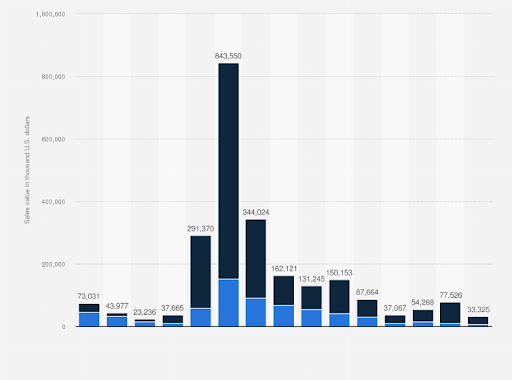

Via Tech Navio

Because NFTs are unique, there isn’t another NFT of the same value available. So, NFTs cannot be used as a form of currency. Think of it as how one unit of real estate can’t be exchanged for another unit of real estate, due to their varying size, costs, and attributes.

How are NFTs taxed?

Every NFT transaction is considered taxable, whether it’s a gain or loss. But because IRS guidance doesn’t exist, we have to look at their guidance on cryptocurrency instead.

Under their crypto regulations guidance, any crypto-to-crypto transaction is a taxable event, meaning NFT trades will be subject to the same laws as crypto transactions. Yet, since NFTs are non-fungible, each token is considered a separate asset with a separate tax history.

In that sense, the following NFT activities are considered taxable gain/loss events:

- Purchasing an NFT with cryptocurrency.

- Trading an NFT for another NFT.

- Selling / disposing of an NFT for fungible cryptocurrency.

According to IRS guidance, fungible cryptocurrencies are categorized as property. Even though NFTs aren’t fungible, they would still pass as personal property under the same tax laws. Cryptocurrency is not treated as non-digital currency in the IRS, it’s treated more as owning stock.

An example of this would be buying a watch with cryptocurrency on a website. The buyer would note the value of their cryptocurrency when it’s acquired to the value of their cryptocurrency when it’s exchanged. If the value appreciates during this time, the appreciation must be reported to the IRS.

Via Statista

Using data lake tools and IRS guidance, tax specialists have concluded that the sale of an NFT is a taxable sale of a property. In the hands of a collector, the NFT would be treated as a capital asset.

Looking to run an epic influencer marketing campaign with NFTs? NeoReach has the best experience in creating viral campaigns that convert on social media. Sign up here!

Investors and creators don’t owe tax until an NFT sells

Imagine you’re a service that provides business phone systems online. You have the product ready to go, but you haven’t received any buyer interest. In NFT taxation, you wouldn’t owe any tax because you have yet to make a sale.

If you’re minting (creating) an NFT, tax returns won’t need to be shared until your NFT sells. It’s the same with painters and authors. Once their product is bought, that income will be recognized as ordinary income and taxed accordingly.

NFT traders will owe taxes if they sell an NFT for profit. But if they are holding an NFT without selling, traders can keep their unrealized gains without paying tax.

The issue is the IRS hasn’t outlined how traders should treat those gains. So it’s unclear if NFTs should be treated as a collectible, income, or a capital gains tax rate.

Collectible tax rate

Collectibles are treated as a special class of capital assets according to the IRS. If your NFT is considered a “collectible” under their guidelines, you will need to pay a maximum tax of 28%.

The IRS defines collectibles as any work of art. As we have embraced digital transformation best practices, we should assume NFTs would fall under this category as well. Collectible NFTs range from music files and artworks, to memes and memorable video clips.

Physical trading cards are classified as “collectibles”. So we can assume trading card-like NFTs such as Curio Cards and Crypto Strikers will be treated the same way.

Income tax rate

Anything that is interpreted as a form of payment for a service can be constituted as income. So if you are selling a hosted business phone system or your Madonna NFT, that income will be taxed.

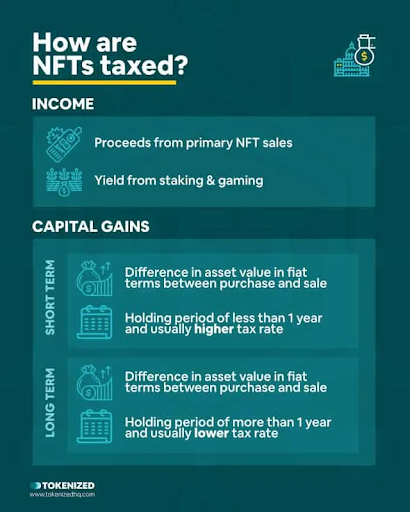

Via Tokenized

Creators and their revenue from NFT sales are taxed as ordinary income. Ordinary income is taxed from 10-37% at the federal level. For most NFT taxation purposes, the income is added to your overall income.

Long-term and short-term capital gains rate

Capital gains mean sellers will owe capital gains tax on net profits. On the flip side, it also ensures any realized losses can be netted against any gains and deducted from their taxable gains.

Real-world asset NFTs (RWANFT) – tokens that denote virtual ownership of a physical good – that are sold after 12 months will likely be taxed at the typical long-term capital gains rate. At this moment in time, long-term capital gains are capped at 20%.

On the other hand, if you sell an NFT within 12 months of receiving it, you’ll fall under the short-term capital gains tax rate. Even if the NFT falls into the collectibles category, you could be taxed up to 37% of your gains.

How are NFTs taxed for sellers?

While minting an NFT is a non-taxable event, transactions involving the selling of newly minted NFTs by their creator will be taxable. Any fees involving the creation and selling of the NFT within the cryptocurrency market should be carefully recorded.

Generally speaking, the federal income rate for NFT creators will be the same as any self-employed artist or creator. Ordinary tax brackets range from 15.3% to 37% being the highest rate.

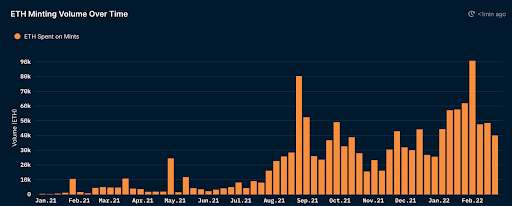

Via Nansen AI

As with any sales, when you sell an NFT that you have created, you will need to report the sale as income and pay taxes on the profit. The primary function of an NFT is to trade, so any profits received from NFT sales will be considered income and taxed accordingly.

Creators will be taxed between 10% to 37% depending on their tax bracket, this is the ordinary income tax rate. But if a creator’s income pushes them into the self-employment bracket, they will be taxed at the level of trade mentioned earlier.

Whether you are paid in dollars, ether, or bitcoin, all your sales need to be reported. Think of it as a CPaaS platform where all modes of currency are connected.

Trading an NFT for another NFT

As previously mentioned, trading an NFT for another is not an exact exchange. The trade will ensure either a capital gain or a capital loss which will need to be reported. Both parties would need to determine the value of NFT given up in the exchange.

If a trader profits from the exchange, such gain will be subject to tax at either a short-term or long-term capital gains rate. Depending on how long the NFT was held.

An example of this would be buying an NFT worth $2,000 and trading it for an NFT worth $3,000 a few months later. You’ll incur a taxable capital gain of $1,000. And vice versa for any capital losses.

Determining the value of an NFT is the hard part. There may be little market valuation available, so determining what documentation the IRS needs is complicated. Traders may need help from a third party for tax purposes.

Creators of an NFT exchange should be subject to ordinary income and self-employment tax.

Bottom line

At this moment in time, NFT taxation remains in a somewhat gray area. Rather than sweeping your taxes under a rug, using the IRS and their guidelines for crypto is probably best practice.

Until the IRS officially rules on the treatment of NFTs and NFT taxation, you should manually keep records of both the NFT and any transactions incurred. I’m sure that’s what Snoop Dogg would do.

Author Bio

Richard Conn is the Senior Director for Demand Generation at 8×8, a leading communication platform with an integrated contact center, voice, video, ip phone, and chat functionality. Richard is an analytical & results-driven digital marketing leader with a track record of achieving major ROI improvements in fast-paced, competitive B2B environments. He has also written for other domains such as Yesware and DoneDone. Check out his LinkedIn.